|

A mysterious computer coder known as Satoshi Nakamoto is credited with inventing bitcoin in 2008. The name Satoshi is a male name of Japanese origin that means Intelligent History. For a time, no one knew who Satoshi was. It was not even known if Satoshi was a single person or a group of people. There is some evidence that Satoshi Nakamoto might be Nick Szabo, an American attorney with strong ties to online cybercommunities. He has spent years experimenting with digital currency and is rarely in the public eye. You can read Nakamoto’s eight-page white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System” at https://nakamotoinstitute.org/bitcoin. Nakamoto’s launch of bitcoin was his answer to the global financial crisis of 2007 – 2008 when the failure of banks and governments jeopardized the world economy. Bitcoin provides a way for direct financial transactions between individuals without the mediation of a bank or government. Many hope that cryptocurrencies will permanently replace fiat money, which is currency whose value is decreed by a government. “Fiat” comes from the Latin, meaning “determination by authority”. Items used for transactions and exchanges between individuals have evolved over centuries from bartering, trading stones and shells, gold and silver, metal coins, paper money, checks, credit and debit cards and most recently cryptocurrency. All currency whatever form it takes, to work well, has to have these qualities:

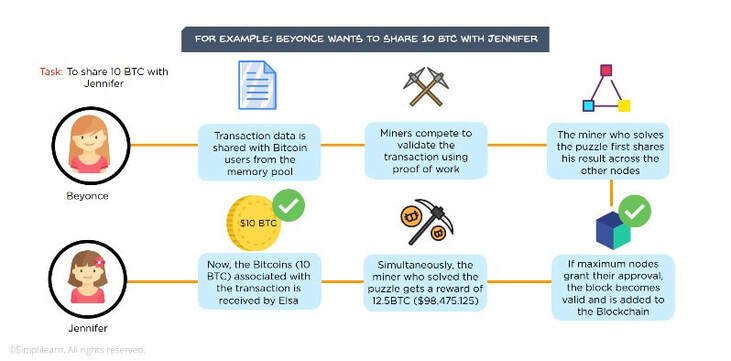

But there are many more, in the thousands at this point in time: Ethereum, Ripple, Litecoin, Tether to name a few. “Crypto” comes from the Greek word, “kryptos” meaning hidden or secret. It is aptly named since the creation of each bitcoin depends on a worldwide network of highly powered computers with specialized software solving highly complex cryptographic algorithms along with blockchain technology. Blockchain technology is a way of tracking, timestamping and verifying transactions, anywhere in the world, between two individuals using computers and smartphones. Each transaction sends out a message to the network where each computer is a node. Tracking and verifying each transaction is done by a “digital miner” or a group of people called a “mining pool”. The first to solve the algorithm is rewarded with a newly minted bitcoin. Once the puzzle is solved and the transaction is verified by the miner(s), the two pieces of the transaction get linked together.    Every ten minutes or so, multiple individual transactions are gathered into a block. This process repeats itself, over and over again, forming an ongoing, unbroken blockchain going back to the original transaction which is the “genesis block”. You may now understand how the miner(s) acquire Bitcoin but how does an ordinary person get it? First, you need a digital wallet which are specialized apps. There are many. Some are free; others charge a fee and offer options not available with a free digital wallet. To get your bitcoin, you can:

So, how has bitcoin measured up to the qualities listed above which are needed for a currency to work well? Recognizable & Widely Accepted Bitcoin is gaining in popularity and use. Its digital emblem appears regularly on multiple social media platforms (see below). BUT bitcoin and other cryptocurrencies are subject to wide fluctuations in value over short periods of time. You could gain a lot but also lose everything quickly. Think of the stock market. It’s not FDIC insured and there is no central authority to regulate it. Interestingly, the lack of a central authority like a bank or government does not exclude your bitcoin transactions from US taxation. Each transaction is considered a taxable event. Notice 2014–21 is an IRS notice which explains how existing general tax principles apply to transactions using virtual currency. Durable Blockchain technology and cryptographic algorithms provide a high level of security making hacking more difficult, but not impossible. Decentralization means that cryptocurrency is distributed across a global network to help remove the risk of fraud and hacking that come with data being held in one centralized place like a bank. But if you lose or forget your password, a new password is NOT an option. Without a password, your cryptocurrency will be durable in your smartphone but NOT accessible. Portable Cryptocurrency is extremely portable on a smartphone or computer. The cryptocurrency is essentially weightless since it’s a bunch of specialized digital files that live on your device, unlike traditional coins or paper money. BUT its portability is dependent on having a smartphone or computer, reliable high-speed Internet access and electricity. Many people in the world still do not have access to all of the above. Divisible Traditional money can only be spent in amounts set by the governments and banks. Bitcoin can be spent in much smaller amounts up to 8 decimal places (0.00000001) called satoshis vs (0.01) for a US penny. This means that bitcoin can be used for very tiny purchases. Limited in supply To avoid a flood of bitcoins, Nakamoto allowed for 21 million bitcoins to be released into circulation over many years. The cryptographic algorithms will grow in difficulty for the remaining bitcoins as their number gets closer to the 21 million mark. Once the 21 million amount is reached, no more bitcoins will be created so the supply will remain limited, retain value and hedge inflationary pressures of traditional currency where the government prints more money leading to the supply outstripping demand resulting in decreased value. Make transactions more efficient and faster Bitcoin, and other cryptocurrencies transactions do not go through a central authority which increases the speed and transmission of the transactions. And miners that timestamp and verify each transaction are motivated by speed to be the first to get the bitcoin rewards. The speed at which miners process transactions is called the hash rate. Now, even large traditional financial institutions are looking at the efficiency and speed that blockchain technology offers. A reverse of their initial criticism. I hope that this blog post gives you some basics about cryptocurrency. There is a lot more to know and understand about cryptocurrency and blockchain technology both their promise and perils. I want to leave you with this important thought: Caveat emptor, a Latin term that means "let the buyer beware." Sources: Books: January, Brendan. Cryptocurrencies and the blockchain revolution. Minneapolis, MN, Twenty-First Century Books, 2021. Field, Jacob. Money: how to save, spend, and manage your moola! New York, Kingfisher, 2021. O'Neil, Andrew. My first guide to bitcoin: an easy read on the cryptic topic. hippocryptical publishing, 2020. Fernn, Ray. Bitcoin for babies: blockchain basics. Yoknee, LLC, 2017. Conley, Kate. Cryptocurrency. Chicago, IL, Norwood Press, 2020. Caras, Michael. Bitcoin money: a tale of Bitville discovering good money. 2019. Ferrie, Chris, and Marco Tomamichel. Blockchain for babies. Sourcebooks Jabberwocky, 2019. Largie, Anthony D. Bitcoin: the future of money. Vol. 5, Kemet Kids Books LLC, 2019. Bitcoin for babies. Code Babies Media, 2018. Harzog, Beverly, et al. How money works: the facts visually explained. New York, DK, 2017. Websites: Internal Revenue Service, www.irs.gov Notice 2014–21  "My first guide to bitcoin: an easy read on the cryptic topic" by Andrew O'Neil. 2020. "Blockchain for babies" by Chris Ferrie and Marco Tomamichel. 2019.  "bitcoin for babies: blockchain basics" by Ray Fernn. 2017   "Bitcoin: the future of money (Kid's guide Volume 5)" by Anthony D. Largie. 2019. Kings of crypto : one startup's quest to take cryptocurrency out of Silicon Valley and onto Wall Street by Jeff John Roberts. 2021.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Curiosity Corner writer & contributor:Helen Beckert, Reference Librarian at the Glen Ridge Public Library Archives

June 2023

Categories |

|

Glen Ridge Public Library

240 Ridgewood Avenue Glen Ridge, NJ 07028 Phone: 973-748-5482 Email: [email protected] © 2024 Glen Ridge Public Library Site last updated July 15, 2024 |

LIBRARY HOURS Monday 9 am - 8 pm Tuesday 9 am - 8 pm Wednesday 9 am - 8 pm Thursday 9 am - 5 pm Friday 9 am - 5 pm Saturday 9 am - 5 pm Sunday CLOSED |

RSS Feed

RSS Feed