|

A few years ago, I watched from my window what I thought was the construction of a new apartment building. I was wrong. Instead, I discovered it was a new self-storage facility: seven floors with 800+ units, air conditioned with an elevator and security cameras. It was then I became intrigued with the self-storage business. And it’s a huge and growing industry. It’s estimated that there are 49,233 facilities in the US alone. These are the largest companies and the top six are publicly traded: Public Storage Extra Space Storage CubeSmart Life Storage National Storage Affiliates U-Haul StorageMart Prime Storage Group SmartShop Asset Management Metro Storage LLC There are smaller enterprises which are privately owned. Here are statistics gleaned from Self-Storage Almanac, the go-to industrial resource. It was first published in 1985: Self-storage facilities users: 79% Residential 14% Businesses 4% Military 3% Students 32% Baby Boomers (1946 – 1964) 32% Generation X (1965 – 1981) 28% Millennials (1982 – 2000) 8% Greatest Generation (1901 – 1924 & over age 75) Most common sizes and average mid-Atlantic monthly cost (2020): 5’ x 5’ $56.48 5’ x 10’ $81.67 10’ x 10’ $131.79 10’ x 15’ $166.00 10’ x 20’ $190.69 Length of Rental – Residential Users: < 3 months 23.6% 3 – 6 months 17.2% 7 – 12 months 19.9% 1 – 2 years 26.5% Longer than 2 years 23.5% Most common reasons for getting a self-storage unit: Moving Lack of space at home Downsizing/Retirement Death Divorce These statistics lead me to explore the psychology behind our compulsive drive to acquire things and the guilt of too much stuff and not enough room for it. Frequent reasons cited that encourage us to collect stuff: Memories, eras of our lives, our past selves, aspirations, the death of loved ones, achievements and security. Self-storage goes hand-in-hand with the currently popular trend of minimalism, professional organizing and our fascination with hoarding side-by- side with traditional collecting. There a spectrum of stuff and a range of responses to help us manage it or rid ourselves of it. Series such as “Hoarders” and “Storage Wars” sparked visibility and interest in hoarding and storage unit auctions. Collecting junk isn’t restricted to the human race, the animal kingdom has its own popular hoarders: pack rats. They gather all sorts of things and store them in their nests that can extend up to four feet in length. Traditionally, we stored our stuff in our basements, garages and attics or those of family and friends. With growing consumerism and cheaper prices, people buy and keep more things. We now outsource much of our stuff to the self-storage industry. A viable alternative in the near future might be self-storage facilities in outer space as the commercial space business grows and becomes less expensive. Ironically, though, even in outer space, junk is a growing concern. More than 27,000 pieces of orbital debris, or “space junk,” are tracked by the Department of Defense's global Space Surveillance Network (SSN) sensors. Much more debris -- too small to be tracked, but large enough to threaten human spaceflight and robotic missions -- exists in the near-Earth space environment. I hope this post gives you an introduction to the U.S. self-storage industry and a few of the reasons that are fueling this flourishing sector of our economy. And perhaps, it’ll give you pause to consider the stuff in your own life and what you want to do with it.    Decker, Jessica. 365 days of organizing : a little help every day to become organized. Bowker, 2020.     www.nasa.gov/mission_pages/station/news/orbital_debris.htmlhttps://www.nasa.gov/mission_pages/station/news/orbital_debris.html

0 Comments

I walk a lot so I see many weeds. I became intrigued by their grit and resiliency. My curiosity opened up a whole new world to me. I even discovered that there are people in universities who study weeds and their properties. Seemingly innocuous and ingenious, weeds form a large part of our natural and urban landscapes. I’d like to broaden your knowledge of and appreciation for them. Weeds are plants that wind up in places they don’t belong, spread by forces of nature: wind, animals (hiding in fur and feathers), ocean currents and human activities. The modern shipping and airline industries gave weeds more efficient ways to travel from one place to another. Away from the predators and diseases that keep them in check in their places of origin, they become invasive and damage the natural balance of ecosystems. Expositions in the late 1800s were places where some plants, now invasive in the US, were showcased for the beauty of their lush foliage and exotic flowers. Their beauty belied their noxious even toxic traits. Kudzu is one of these mythic weeds. Bill Finch’s Smithsonian article puts kudzu history in the US in prospective: "The true story of kudzu, the vine that never truly ate the South: a naturalist cuts through the myths surrounding the invasive plant". https://www.smithsonianmag.com/science-nature/true-story-kudzu-vine-ate-south-180956325/ Weeds are tenacious and hardy but much misaligned. They can be exotic, invasive, benign and poisonous. Some have medicinal and culinary uses. They can be found flourishing in abandoned lots, sidewalk cracks, fields and farms and even in our curated gardens. Weeds have an ability to thrive with a bit of sun, small amounts of soil and space plus many are drought-resistant. Perhaps, one day, these strengths that lie in their genes will be harnessed. When you’re out walking, keep your eyes peeled. You’ll be astonished by the array of weeds that you’ll see. Here are photos of two local weeds. I found them thriving in an empty lot on Bloomfield Avenue. Pokeweed Princess Tree Below are some websites to help you widen your weed worldview. Cornell University has a weed garden news.cornell.edu/stories/2015/08/garden-offers-living-library-weeds-poisonous-plants Cornell’s Weed Science Program develops educational programs and conducts applied research in weed biology and management for growers of vegetables, grapes, turf, and ornamentals in the field, containers, and in the landscape. Check out the Weed Science Society of America which was founded in 1956. It is a non-profit professional society promoting research, education, and awareness of weeds in managed and natural ecosystems. https://wssa.net/ Find local weeds in the Rutgers Weed Gallery https://njaes.rutgers.edu/weeds/ There is a practical reason for familiarizing yourselves with weeds, too. Many are toxic to small children and pets. Google Lens app is option to help you ID weeds Another useful app is Picture This - Plant Identifier. The New Jersey Poison Control Center https://www.njpies.org/hotline/ The ASPCA website contains a list of toxic and non-toxic weeds and plants for dogs, cats and horses https://www.aspca.org/pet-care/animal-poison-control/toxic-and-non-toxic-plants/a And I discovered that there are Weed Warrior programs which use volunteers help control the growth of invasive weeds. One example, is in Montgomery, MD https://www.montgomeryparks.org/caring-for-our-parks/natural-spaces/weed-warriors/ I’ll end here on a more positive note. Who knows what benefits will be derived from weeds once their virtues ARE discovered. Bibliography  Del Tredici, Peter. Wild urban plants of the Northeast: a field guide. Ithaca, NY, Cornell University Press, 2010.  Stewart, Amy. Wicked plants: the weed that killed Lincoln's mother & other botanical atrocities. Chapel Hill, NC: Algonquin Books of Chapel Hill, 2009.  Mabey, Richard. Weeds: in defense of nature's most unloved plants. New York, HarperCollins, 2010.  Jenson - Elliott, Cindy. Weeds find a way. New York, Beach Lane Books, 2014.  Souza, D.M. Plant invaders. New York, Franklin Watts, 2003.  Jones, Pamela. Just weeds: history, myths, and uses. New York, Prentice Hall, 1981.  Rollin Spencer, Edwin. All about weeds. New York, Dover Publications, 1974. A mysterious computer coder known as Satoshi Nakamoto is credited with inventing bitcoin in 2008. The name Satoshi is a male name of Japanese origin that means Intelligent History. For a time, no one knew who Satoshi was. It was not even known if Satoshi was a single person or a group of people. There is some evidence that Satoshi Nakamoto might be Nick Szabo, an American attorney with strong ties to online cybercommunities. He has spent years experimenting with digital currency and is rarely in the public eye. You can read Nakamoto’s eight-page white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System” at https://nakamotoinstitute.org/bitcoin. Nakamoto’s launch of bitcoin was his answer to the global financial crisis of 2007 – 2008 when the failure of banks and governments jeopardized the world economy. Bitcoin provides a way for direct financial transactions between individuals without the mediation of a bank or government. Many hope that cryptocurrencies will permanently replace fiat money, which is currency whose value is decreed by a government. “Fiat” comes from the Latin, meaning “determination by authority”. Items used for transactions and exchanges between individuals have evolved over centuries from bartering, trading stones and shells, gold and silver, metal coins, paper money, checks, credit and debit cards and most recently cryptocurrency. All currency whatever form it takes, to work well, has to have these qualities:

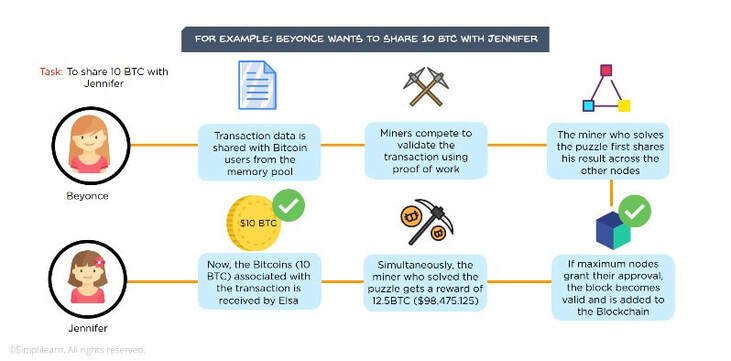

But there are many more, in the thousands at this point in time: Ethereum, Ripple, Litecoin, Tether to name a few. “Crypto” comes from the Greek word, “kryptos” meaning hidden or secret. It is aptly named since the creation of each bitcoin depends on a worldwide network of highly powered computers with specialized software solving highly complex cryptographic algorithms along with blockchain technology. Blockchain technology is a way of tracking, timestamping and verifying transactions, anywhere in the world, between two individuals using computers and smartphones. Each transaction sends out a message to the network where each computer is a node. Tracking and verifying each transaction is done by a “digital miner” or a group of people called a “mining pool”. The first to solve the algorithm is rewarded with a newly minted bitcoin. Once the puzzle is solved and the transaction is verified by the miner(s), the two pieces of the transaction get linked together.    Every ten minutes or so, multiple individual transactions are gathered into a block. This process repeats itself, over and over again, forming an ongoing, unbroken blockchain going back to the original transaction which is the “genesis block”. You may now understand how the miner(s) acquire Bitcoin but how does an ordinary person get it? First, you need a digital wallet which are specialized apps. There are many. Some are free; others charge a fee and offer options not available with a free digital wallet. To get your bitcoin, you can:

So, how has bitcoin measured up to the qualities listed above which are needed for a currency to work well? Recognizable & Widely Accepted Bitcoin is gaining in popularity and use. Its digital emblem appears regularly on multiple social media platforms (see below). BUT bitcoin and other cryptocurrencies are subject to wide fluctuations in value over short periods of time. You could gain a lot but also lose everything quickly. Think of the stock market. It’s not FDIC insured and there is no central authority to regulate it. Interestingly, the lack of a central authority like a bank or government does not exclude your bitcoin transactions from US taxation. Each transaction is considered a taxable event. Notice 2014–21 is an IRS notice which explains how existing general tax principles apply to transactions using virtual currency. Durable Blockchain technology and cryptographic algorithms provide a high level of security making hacking more difficult, but not impossible. Decentralization means that cryptocurrency is distributed across a global network to help remove the risk of fraud and hacking that come with data being held in one centralized place like a bank. But if you lose or forget your password, a new password is NOT an option. Without a password, your cryptocurrency will be durable in your smartphone but NOT accessible. Portable Cryptocurrency is extremely portable on a smartphone or computer. The cryptocurrency is essentially weightless since it’s a bunch of specialized digital files that live on your device, unlike traditional coins or paper money. BUT its portability is dependent on having a smartphone or computer, reliable high-speed Internet access and electricity. Many people in the world still do not have access to all of the above. Divisible Traditional money can only be spent in amounts set by the governments and banks. Bitcoin can be spent in much smaller amounts up to 8 decimal places (0.00000001) called satoshis vs (0.01) for a US penny. This means that bitcoin can be used for very tiny purchases. Limited in supply To avoid a flood of bitcoins, Nakamoto allowed for 21 million bitcoins to be released into circulation over many years. The cryptographic algorithms will grow in difficulty for the remaining bitcoins as their number gets closer to the 21 million mark. Once the 21 million amount is reached, no more bitcoins will be created so the supply will remain limited, retain value and hedge inflationary pressures of traditional currency where the government prints more money leading to the supply outstripping demand resulting in decreased value. Make transactions more efficient and faster Bitcoin, and other cryptocurrencies transactions do not go through a central authority which increases the speed and transmission of the transactions. And miners that timestamp and verify each transaction are motivated by speed to be the first to get the bitcoin rewards. The speed at which miners process transactions is called the hash rate. Now, even large traditional financial institutions are looking at the efficiency and speed that blockchain technology offers. A reverse of their initial criticism. I hope that this blog post gives you some basics about cryptocurrency. There is a lot more to know and understand about cryptocurrency and blockchain technology both their promise and perils. I want to leave you with this important thought: Caveat emptor, a Latin term that means "let the buyer beware." Sources: Books: January, Brendan. Cryptocurrencies and the blockchain revolution. Minneapolis, MN, Twenty-First Century Books, 2021. Field, Jacob. Money: how to save, spend, and manage your moola! New York, Kingfisher, 2021. O'Neil, Andrew. My first guide to bitcoin: an easy read on the cryptic topic. hippocryptical publishing, 2020. Fernn, Ray. Bitcoin for babies: blockchain basics. Yoknee, LLC, 2017. Conley, Kate. Cryptocurrency. Chicago, IL, Norwood Press, 2020. Caras, Michael. Bitcoin money: a tale of Bitville discovering good money. 2019. Ferrie, Chris, and Marco Tomamichel. Blockchain for babies. Sourcebooks Jabberwocky, 2019. Largie, Anthony D. Bitcoin: the future of money. Vol. 5, Kemet Kids Books LLC, 2019. Bitcoin for babies. Code Babies Media, 2018. Harzog, Beverly, et al. How money works: the facts visually explained. New York, DK, 2017. Websites: Internal Revenue Service, www.irs.gov Notice 2014–21  "My first guide to bitcoin: an easy read on the cryptic topic" by Andrew O'Neil. 2020. "Blockchain for babies" by Chris Ferrie and Marco Tomamichel. 2019.  "bitcoin for babies: blockchain basics" by Ray Fernn. 2017   "Bitcoin: the future of money (Kid's guide Volume 5)" by Anthony D. Largie. 2019. Kings of crypto : one startup's quest to take cryptocurrency out of Silicon Valley and onto Wall Street by Jeff John Roberts. 2021. |

Curiosity Corner writer & contributor:Helen Beckert, Reference Librarian at the Glen Ridge Public Library Archives

June 2023

Categories |

|

Glen Ridge Public Library

240 Ridgewood Avenue Glen Ridge, NJ 07028 Phone: 973-748-5482 Email: glrgcirc@bccls.org © 2024 Glen Ridge Public Library Site last updated April 30, 2024 |

LIBRARY HOURS Monday 9 am - 8 pm Tuesday 9 am - 8 pm Wednesday 9 am - 8 pm Thursday 9 am - 5 pm Friday 9 am - 5 pm Saturday 9 am - 5 pm Sunday CLOSED |

RSS Feed

RSS Feed